- Market Overview

- Futures

- Options

- Charts

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Hedging Resource Center

- Farmer's Almanac

- USDA Reports

How Is Ventas' Stock Performance Compared to Other Real Estate Stocks?

With a market cap of $30.6 billion, Ventas, Inc. (VTR) is a leading healthcare REIT with a diverse portfolio of approximately 1,400 properties across the U.S., Canada, and the U.K. Focused on serving the growing aging population, Ventas invests in senior housing communities, medical office buildings, research & innovation centers, and healthcare facilities.

Companies valued at more than $10 billion are generally considered “large-cap” stocks, and Ventas fits this criterion perfectly. Leveraging its operational expertise, strategic partnerships, and data-driven insights, the company delivers strong performance while enabling healthier, longer, and more fulfilling lives.

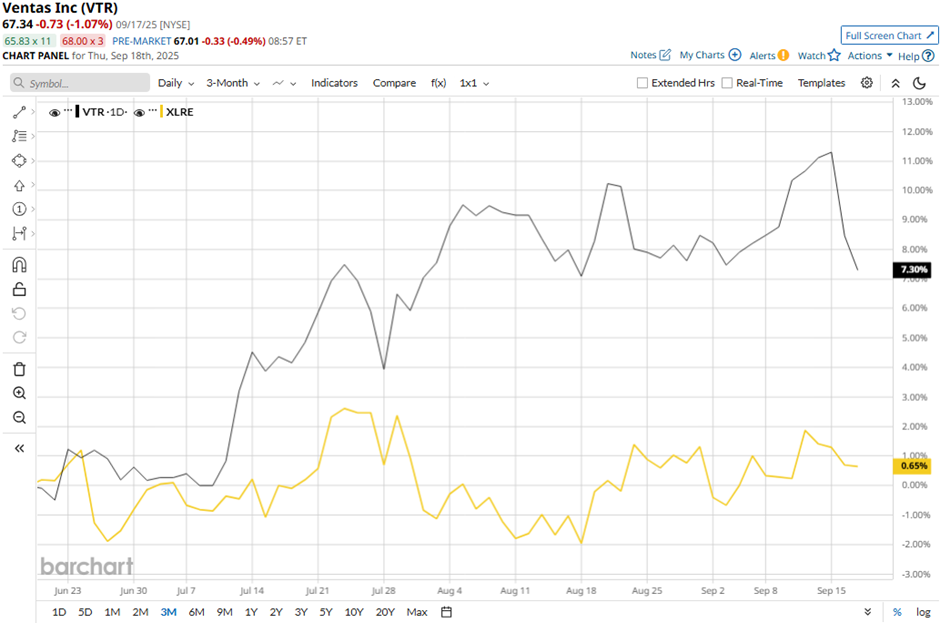

Despite this, shares of the Chicago, Illinois-based company have fallen 5.6% from its 52-week high of $71.36. VTR stock has risen 7.5% over the past three months, outperforming the Real Estate Select Sector SPDR Fund’s (XLRE) marginal return during the same period.

Longer term, the seniors housing REIT’s shares have increased 14.5% on a YTD basis, outpacing XLRE's 3.3% gain. Moreover, the stock has gained nearly 5% over the past 52 weeks, compared to XLRE's 6.3% drop over the same time frame.

VTR stock has been trading above its 200-day moving average since last year.

Shares of Ventas recovered 1.1% following its Q2 2025 results on Jul. 30. The company posted normalized FFO of $0.87 per share, beating the consensus estimate and rising 9% year-over-year, alongside revenues of $1.42 billion, which surpassed estimates and grew 18.3%. Strong performance in the senior housing operating portfolio (SHOP), with same-store NOI up 13.3% and occupancy climbing 240 bps to 87.6%.

Further, Ventas boosted its 2025 normalized FFO guidance to $3.41 per share - $3.46 per share and raised its senior housing investment outlook to $2.0 billion.

In contrast, its rival, Welltower Inc. (WELL) has outpaced VTR stock. WELL stock has soared 31.9% on a YTD basis and 30.2% over the past 52 weeks.

Despite VTR’s underperformance relative to its industry peers, analysts are bullish, with a consensus rating of "Strong Buy" from 20 analysts. The mean price target of $77.39 represents a premium of 14.9% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.